Performing regular paystub and timecard audits is an essential practice for any organization’s HR compliance program. As a business leader, you’re no stranger to the importance of compliance in the workplace. Among the multitude of tasks on your plate, ensuring adherence to labor laws, such as the Fair Labor Standards Act (FLSA), is non-negotiable. That’s where paystub and timecard audits come into play.

In essence, these audits serve as an essential tool in your HR compliance arsenal, helping you align with key labor regulations, especially those related to overtime. The secret to successful compliance? Regularity. Conducting these audits routinely, for example, on an annual basis, allows you to catch potential discrepancies early and fix them before they escalate into larger issues.

Understanding the ins and outs of paystub and timecard audits can be complex, but you don’t have to navigate these waters alone. The JorgensenHR team of experienced professionals is ready to partner with you, guiding you through every step to ensure complete compliance with labor laws.

If you’re an HR manager seeking to streamline your compliance processes and safeguard your business from potential legal pitfalls, why not let JorgensenHR take the helm? Take the first step towards peace of mind by getting in touch with us today.

Step 1: Gather Needed Documents

The first step of the audit process is collecting all the relevant documentation you’ll need to review paystub and timecard accuracy and compliance.

To start, pull together paystubs from a sample of employees over the last quarter. Aim for 10-20% of your workforce, with representation across departments, roles, and salary levels.

You’ll also need the timecards or other hourly records showing the exact hours worked each day by the same sample of employees. Make sure the dates align to the pay period on the paystubs you selected.

In addition, gather the company policies related to pay practices like:

- Overtime eligibility and pay rates

- Meal and rest break schedules

- Pay cycles, pay days, corrections/adjustments

And lastly, have copies of state and federal labor laws on hand pertaining to:

- Overtime calculations

- Meal and rest break requirements

- Paystub contents and delivery

- Record keeping periods

With these core documents collected and organized, you’ll be ready to begin reviewing and auditing the data.

Step 2: Review Paystub Accuracy

Now it’s time to start reviewing the paystub samples you gathered to confirm accuracy and compliance. Here’s how to go about it:

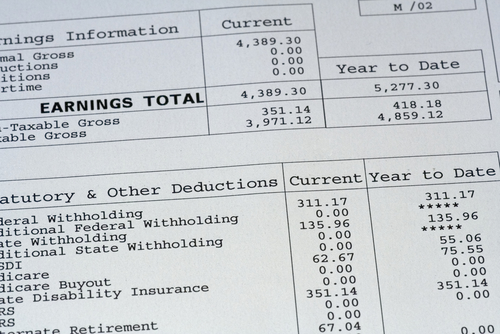

First, pull out your state labor law information and check that each paystub contains all the required elements. This usually includes things like:

- Employee name and ID number

- Employer name, address, contact

- Pay period dates

- Date issued

- Total hours worked

- Rate of pay

- Gross wages

- Itemized deductions and withholdings

- Accrued vacation and sick leave

- Net pay

Ensure none of the legally required details are missing.

Next, cross-check pay period dates, pay date, taxes, and deductions on each paystub. They should align with your records and the timeframe you’re auditing. An accurate paystub should clearly indicate the start and end date of the pay period and should reflect the appropriate deductions such as state and federal taxes, social security, and healthcare premiums.

Lastly, ensure that the hourly rate on the paystub matches your company records and policies. This is crucial, particularly if your employees work at different rates, such as a higher rate for overtime or a lower rate for training.

Look for any discrepancies, make notes on any errors you find, and follow up on incorrect rates or calculations. The goal is to flag any inconsistencies between the paystubs and your company’s documented policies or precedent.

Step 3: Verify Timecards Match Hours Paid

Now comes the critical step of cross checking the timecards against the paystubs for your sample of employees. You’re reviewing that the hours worked align accurately to the hours compensated. This is an integral part of your audit, allowing you to identify any potential discrepancies and correct them in a timely manner.

Go through each timecard and paystub pair and compare:

- The total regular hours worked versus regular hours paid

- Any overtime hours logged versus overtime hours paid

- Meal break deductions match breaks noted on timecard

Document any discrepancies where the paystub hours differ from the actual hours worked per the timecard. Any irregularities should be noted for further investigation. Pay special attention to:

- Accurate overtime pay – any OT worked should be paid at proper rate, the regular rate of pay not the employee’s hourly rate

- Missed or shorted meal breaks – review break compliance

- Unpaid time – any noted hours without compensation

Lagging timecards or rounding errors can lead to incorrect totals. Note patterns and determine necessary corrections or policy changes. Don’t let uncompensated overtime or unpaid wages go unaddressed. By ensuring these aspects align, you’re not only fostering a transparent and fair work environment, but also maintaining a solid stance of compliance with labor laws.

Step 4: Look for Policy Violations

With the timecards and paystubs thoroughly reviewed, you can now examine them for any signs of policy violations.

Use your gathered state and federal labor law references to check that:

- Overtime was paid correctly whenever an employee worked over 40 hours or met other OT thresholds. If an employee has logged overtime hours, ensure they’ve been compensated at the appropriate rate – typically 1.5 times the regular pay rate for any hours worked beyond 40 in a workweek, as per the FLSA.

- Meal and rest break policies align with legal requirements on duration and frequency. Break laws can vary greatly by state, so ensure your company’s practices align with the specific laws of the states you operate in.

- No other labor regulations were violated. These might relate to minimum wage requirements, improper classifications of employees, or incorrect handling of paid leave, among other things.

Note any discrepancies where real-world practice differed from written policies or labor law requirements. For example:

- Failure to pay OT at time-and-a-half rates

- Missed or shorted breaks

- Timecards not completed properly

Identifying areas where policies weren’t followed allows you to take corrective action and get practices back into compliance. This protects both the company and employees.

Bring any concerning findings or trends to the appropriate department’s attention for fixing and prevention. Consistent audits reinforce compliance and fair compensation.

Step 5: Address Any Issues Found

The paystub and timecard audit process is intended to identify areas of non-compliance and errors so they can be addressed quickly. Don’t let problems linger – take action!

First, if the audit reveals any individual pay errors for the sample of employees, work to get those corrected right away. Issue new, accurate paystubs as needed. Provide back pay if compensation was missed.

Look for patterns and systematic issues that caused multiple errors:

- Are managers incorrectly calculating overtime?

- Is software misaligning hours worked and hours paid?

- Do meal and rest break policies need updating?

Fix the root causes of recurring errors. Review and update policies and software rules if needed.

Provide additional training and refreshers for managers and supervisors on proper practices for:

- Timecard management

- Overtime pay

- Meal/rest break compliance

- Wage calculations

Ongoing education ensures knowledge stays current and errors don’t recur.

Conducting an audit is a proactive measure that shows your commitment to compliance, fair pay, and a healthy workplace. But the real value comes in using what you’ve learned from the audit to make necessary changes. With these corrections and training in place, you’ll be well-equipped to maintain compliance and avoid pay-related issues in the future. Remember, a well-executed audit today paves the way for a trouble-free HR landscape tomorrow.

At JorgensenHR, we make paystub and timecard audits easy. Our dedicated Compliance team handles the entire audit process for you. We identify errors, provide corrections guidance, and deliver detailed reports to confirm your organization remains in compliance.

Don’t risk litigation – get comprehensive audit services from the proven HR compliance experts. Contact us today to review your pay practices, maintain accuracy, and have peace of mind that your labor law responsibilities are covered. Focus on your core business while we tackle the details. Call 661-600-2070 or email info@jorgensenhr.com to get started!

Recent Comments